The Split MA Metatrader 5 indicator is a modified moving average that displays two distinct components i.e. the bullish and bearish of a moving average over a specified time period, within a separate window.

Traders will find three input parameters within the Split_MA custom indicator:

Period – defines the components calculation period with a default value of 14. If this value is modified upwards less crosses are witnessed, thereby making it suitable for long-term trader under such settings.

If the value is modified downward we’ll get incidents of increased crosses, making it suitable for scalpers (short term traders);

Applied price – defines the moving average calculation price;

Method – defines the moving average calculation method.

Free Download

Download the “Split_MA.ex5” MT5 indicator

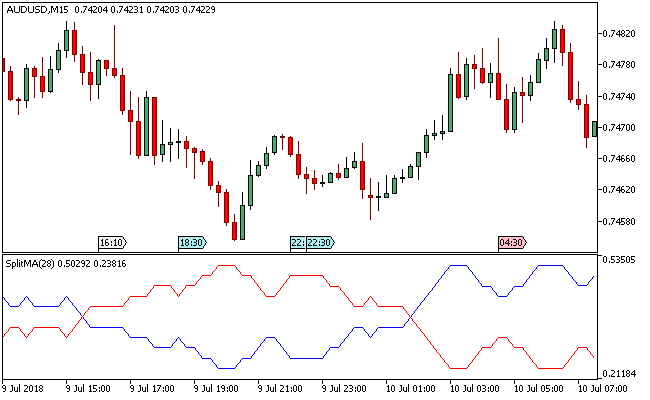

Example Chart

The Split_MA MT5 indicator comes in a separate window with two lines that are seen crisscrossing themselves in the course of market movements.

There is the red line and also the blue line, and if the red line crosses above the blue line, price is said to be taken higher i.e. a trigger to buy the stipulated forex pair.

Seemingly, if the blue line crosses above the red line, it is indicative of bearish price pressure.

Just like a lot of MT5 custom indicators, they are less potent as standalone indicators and will work better when in use with other technical tools.

Download

Download the “Split_MA.ex5” Metatrader 5 indicator

MT5 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 5

Type: chart pattern indicator

Customization options: Variable (Period, Applied price, Method), Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: trend

Installation

Copy and paste the Split_MA.ex5 indicator into the MQL5 indicators folder of the Metatrader 5 trading platform.

You can access this folder from the top menu as follows:

File > Open Data Folder > MQL5 > Indicators (paste here)