The Price on Bollinger Bands Channel Metatrader 5 forex indicator plots the Bollinger Bands in relation to the moving average and projection of the candlesticks in a separate window.

The indicator’s drawing looks like a pulse.

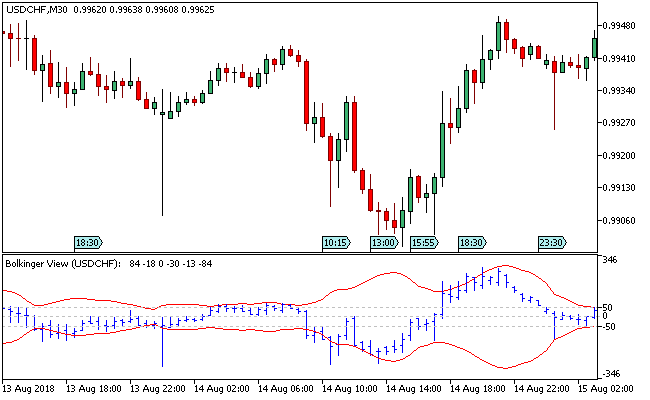

The red lines represents the Bollinger Bands, while the open, high, low and close are shown as blue filled price bars within the same indicator window.

The default Bollinger Bands period is set at 15, while its deviation has a value of 2.

Price can be drawn as Close, Open, High, Low, Median, Typical or Weighted, depending on the traders preferred usability.

Free Download

Download the “bb_price_on_channel.ex5” MT5 indicator

Example Chart

The USD/CHF M30 chart below displays the Price on Bollinger Bands Channel forex indicator in action.

Basic Trading Signals

Buy Signal: Go long when the red lines of the indicator widens following a contraction, and the blue price bars are seen trading above the -50 level.

Sell Signal: Go short when the red lines of the indicator widens after the lines constricts, and the blue price bars are seen trading below the 50 level.

Exit buy trade: Close all buy orders if while a bullish trend is ongoing, the red lines of the indicator narrows.

Exit sell trade: Close all sell orders if while a bearish trend is ongoing, the red lines of the indicator squeezes.

Tips: It is recommended to use the indicator in conjunction with other trend tools when developing trading strategies.

Download

Download the “bb_price_on_channel.ex5” Metatrader 5 indicator

MT5 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 5

Type: chart window indicator

Customization options: Variable (period, deviation, price), Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: volatility | trend

Installation

Copy and paste the bb_price_on_channel.ex5 indicator into the MQL5 indicators folder of the Metatrader 5 trading platform.

You can access this folder from the top menu as follows:

File > Open Data Folder > MQL5 > Indicators (paste here)